Bitcoin Charts Analysis of Bitcoin Chart Patterns

Bitcoin Chart Patterns - Bitcoin Trading Analysis Chart Patterns Bitcoin Trading StrategiesCryptocurrency chart patterns are graphical representations of repeating bitcoin price action formations that are commonly used in the btcusd trading market.

Bitcoin Chart Patterns is one of the studies used in cryptocurrency trading technical analysis to help bitcoin traders learn how to recognize these repeating Cryptocurrency Chart Patterns formations.

These Cryptocurrency Chart Patterns are important in bitcoin trading because when the btcusd trading market is not moving in a particular direction it is forming a cryptocurrency chart pattern. It is important to know these Cryptocurrency Chart Patterns formations so as to have an idea of what might be the next move in the btcusd trading market.

When bitcoin price movements are drawn there are several Cryptocurrency Chart Patterns formations that occur naturally and repeat themselves over and over again. These Cryptocurrency Chart Patterns formations are used by a lot of cryptocurrency trading technical traders to predict the next cryptocurrency market move.

Traders often study these Cryptocurrency Chart Patterns formations to gauge supply and demand forces that form the basis for bitcoin price fluctuations.

These Cryptocurrency Patterns are classified in to 3 different categories:

1. Reversal Bitcoin Chart Patterns

- Double tops Bitcoin Chart Patterns

- Double bottom Bitcoin Chart Patterns

- Head and shoulders Bitcoin Chart Patterns

- Reverse head and shoulders Bitcoin Chart Patterns

2. Continuation Bitcoin Chart Patterns

- Ascending triangle Bitcoin Chart Patterns

- Descending triangle Bitcoin Chart Patterns

- Bull flag/pennant Bitcoin Chart Patterns

- Bear flag/pennant Bitcoin Chart Patterns

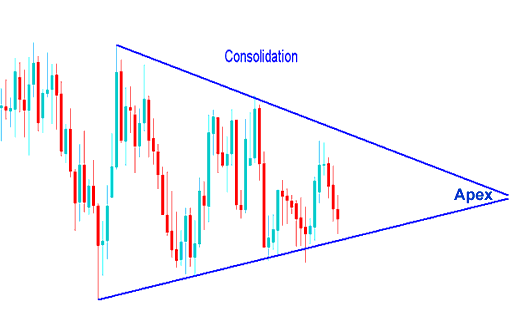

3. Bilateral

- Symmetric triangle - Consolidation Bitcoin Chart Patterns

- Rectangle - Range Bitcoin Chart Patterns

Reversal patterns - Bitcoin Chart Patterns - confirm the reversal of the btcusd trading market bitcoin trend once this reversal cryptocurrency chart pattern setup is confirmed. These Reversal Cryptocurrency Chart Patterns are formed after extended cryptocurrency trading market trend either upward or downwards and these reversal bitcoin patterns signal that the btcusd trading market is ready to reverse.

Continuation patterns Bitcoin Chart Patterns - are formations that set up the btcusd trading market for a bitcoin trend continuation move in the direction of the prior Bitcoin trend. These Continuation Cryptocurrency Chart Patterns are formed when the btcusd trading market is taking a pause before continuing in the same direction of the previous Bitcoin trend.

Consolidation patterns Bitcoin Chart Patterns - form when the btcusd trading market is taking a break before deciding which is the next direction to take. When these Consolidation Cryptocurrency Chart Patterns are formed - the btcusd market is trying to decide which direction to trade.

Technical Bitcoin Chart Analysis of Bitcoin Chart Patterns

There are two different types of btcusd chart analysis, these two might seem similar but are not: the two are:

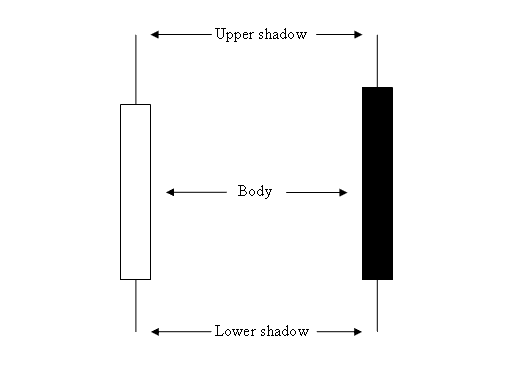

- Japanese Candlesticks Patterns - Study of a single candlestick - Read Japanese Bitcoin Candlesticks Patterns

- Bitcoin Chart Patterns - Study of a series of crypto candlesticks formations

(This learn bitcoin trading tutorial is about the second option above - Bitcoin Chart Patterns)

The different topics for these two types cryptocurrency trading analysis are:

Japanese Bitcoin Candlesticks

Bitcoin Patterns Tutorials

The examples below also illustrate the difference of the arrangements of these two cryptocurrency trading technical analysis methods.

Candles Patterns - Study of a single candlestick

Bitcoin Chart Patterns - Study of a series of bitcoin candlestick s