Draw Down and Maximum Draw-down

In a business in order to make a profit a trader must learn how to manage risks. To make profits in trading you need to learn about various bitcoin money management methods discussed on this learn Bitcoin tutorial web site.

When it comes to trading, the risks to be managed are potential losses. Using bitcoin trading money management guidelines will not only protect your bitcoin account but also make you profitable in the long run.

Draw-down

As traders the number one risk is known as draw-down - this is the amount of money you've lost in your cryptocurrency account on a single bitcoin trading transaction.

If you have $10,000 capital & you make a loss in one trade of $500, then your drawdown is $500 divided by $10,000 which is 5 percent draw-down.

Maximum Draw-down

This is the total amount of money you have lost in your cryptocurrency account before you start making profitable trades. For example if you have $10,000 capital & make 5 consecutive losing trade transactions with a total of $1,500 loss before making 10 winning trade positions with a total of $4,000 trading profit. Then the draw down is $1,500 divided by $10,000, which is 15% maximum draw down.

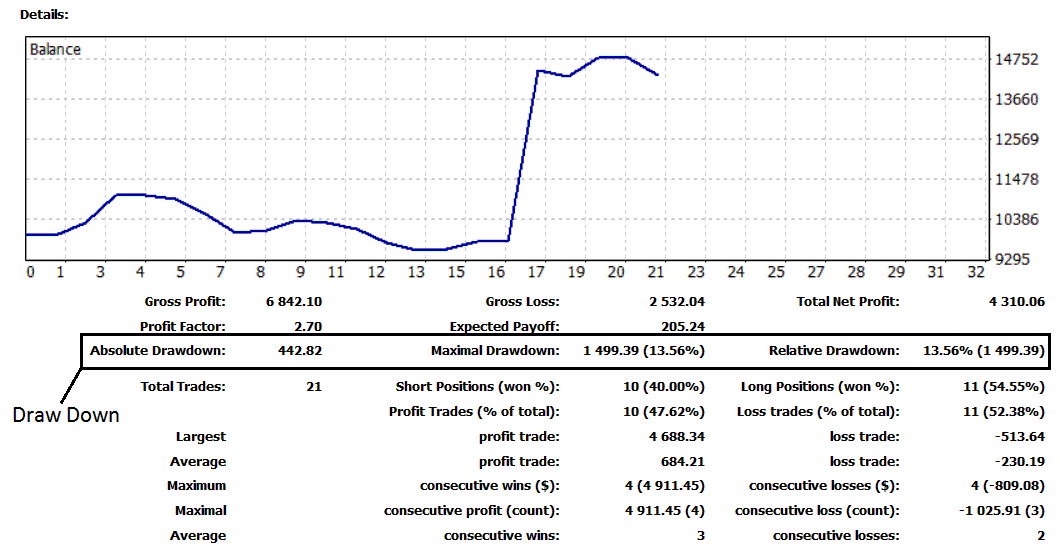

DrawDown is $442.82 (4.40%)

Maximum Draw Down is $1,499.39 (13.56 %)

To learn how to generate the above reports using MT4 platform: Generate Reports on MT4 Guide

Bitcoin Trade Money Management

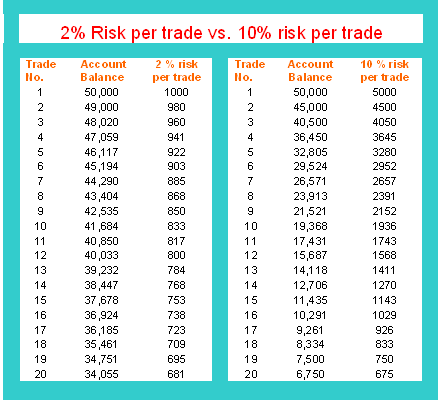

The example illustrated below shows the difference between risking a small percentage of your trading capital compared to risking a higher %. Good investment principles requires you as a not to risk more than 2% of your total trading account equity.

Percentage Risk Technique

2 percent and 10 percent Risk Rule

There is a large contrast between risking 2% of your equity compared to risking 10% of your equity on one transaction.

If you happened to experience a losing streak and lost only 20 trades in a row, you would have gone from beginning trading account balance of $50,000 to having only $6,750 left in your account if you risked 10 % on each trade position. You would have lost over 87.50 % of your equity.

However, if you risked only 2 % you would have still had $34,055 which is only a 32 % loss of your total equity. This is why it's best to use the 2 % risk management strategy

Difference between risking 2 % & 10 % is that if you risked 2 % you would still have $34,055 after 20 losing trades.

However, if you risked 10 % you'd only have $32,805 after only 5 losing trades that is less than what you would have if you risked only 2 % of your trading account and lost all 20 trades.

The point is you want to setup your rules so that when you do have a loss making period, you'll still have enough trading capital to trade the next time.

If you lost 87.50 % of your trading capital you'd have to make 640 % profit to get back to break-even.

As compared to if you lost 32 % of your capital you would have to make 47 % profit to go back to break even. To compare it with the examples 47 % is a lot easier to break even than 640% is.

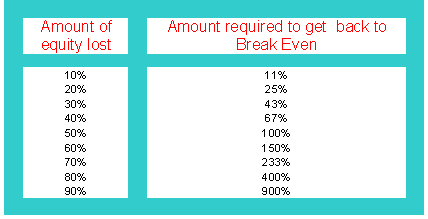

Chart below shows what percent you'd have to make to get back to break even if you were to lose a certain percentage of your capital.

Concept of Break Even

Account Equity & Break Even

At 50% draw-down, one would have to earn 100 % on their invested capital - a feat accomplished by less than 5% of all traders globally - just to break-even on an-accounta-trading-account with a 50% loss.

At 80% draw-down, one must quadruple their account equity just to take back to its original equity. This is what is called to "break-even" i.e. Get back to your original trading account balance which you deposited.

The more you lose, the harder it is to make it back to your initial account size.

This is the reason why as a trader you should do everything you can to PROTECT your equity. Do not accept to lose more than 2 percent of your account equity on any 1 single trade transaction.

Bitcoin risk management is about only risking a small percentage of your trading capital in each trade transaction so that you can survive your losing streaks and avoid a large draw down on your trading account.

In Bitcoin, traders use stop loss cryptocurrency orders which are put in order to minimize losses. Controlling risks it involves putting a stop loss bitcoin order after placing an order.

Effective Risk Management

Effective risk management requires controlling all trading risks. A trader should create a clear bitcoin trading money management system & a trading plan. To be in Bitcoin or in any other business you must make decisions involving some risk. All aspects should be measured to keep risk to a minimum and use the above tips on this tutorial.

Ask yourself? Some Tips

1. Can the risks to your investing activities be identified, what forms do they take? & are they clearly understood & planned for? All the risks should be taken care of in your Bitcoin plan.

2. Do you grade the risks faced by you when trading in a structured way? - Do you've a trading plan? - have you read about this course which is thoroughly covered discussed here on this Site.

3. Do you know the maximum potential risk of each exposure for each transaction that you place?

4. Are decisions made on the basis of reliable and timely data & based on a strategy or not? Have you read about bitcoin systems here on this website tutorial tutorials.

5. Are the risks large in relation to the turnover of your invested capital & what impact could they have on your profits margins and your margin requirements?

6. Over what trading time periods do risks of your trading activities exist? - Do you hold trades long-term or short-term? what type of trader are you?

7. Are the exposures a one-off or are they recurring?

8. Do you know enough about the ways in which your Bitcoin risks can be reduced or hedged and what it would cost if you did not include these measures to reduce potential loss, & what impact would it make to any up side of your profit?

9. Have your rules been adequately addressed, to ensure that you make and keep your profits.