BTCUSD Trading Introduction

Bitcoin trading online is gaining popularity among online traders. Bitcoin is one of the financial instruments provided for trading online that a trader can choose. Bitcoin is a Cryptocurrency that can be traded in the same way as other online currencies. BTCUSD (Bitcoin / US Dollar) can now be traded as a cash CFD.

CFDs are contracts that are traded online and these contracts replicate the cash price of the underlying instrument. These contracts will be traded based on the current price of Bitcoin.

Bitcoin is now gaining more popularity as a digital currency than any other online currency.

Bitcoin now is provided for trading alongside the traditional currencies traded in the online Forex market.

Traders can now trade Bitcoins without the need for a Bitcoin Wallet. By trading bitcoin as a CFD traders can now trade bitcoin alongside Forex Currencies such as Euro Dollar - EURUSD or Pound Dollar - GBPUSD.

Bitcoin can now be traded against the US Dollar using the Currency pair BTCUSD.

BTCUSD is the Symbol used to trade BTCUSD online without the need of a Bitcoin Wallet; BTCUSD in online trading is traded as a Contract for Difference - CFD.

Unlike other currencies that are based on centralized banking systems, bitcoin uses a decentralized control based on peer-to-peer technology that allows BTCUSD to operate without any centralized authorities or central banks. The core component of bitcoin is the blockchain - this blockchain serves as a public ledger of all Bitcoin transactions.

Trading Bitcoin Through Online Forex Brokers

When trading Bitcoin through an online Forex broker like XM, a trader does not need a Bitcoin Wallet, but instead a trader will be speculating on the price of Bitcoin. This way as a trader you will be trading on Bitcoin CFD.

You don't actually need to own Bitcoins and therefore you do need to own a Bitcoin Wallet. In online trading through an online Forex Broker a trader will be trading a contract of Bitcoins - this contract will represent Bitcoins - once you buy or sell you will make profit or loss based on the price movement calculation.

If you buy a contract of Bitcoin CFD and the price moves up in your favor, then you can close this bitcoin buy position and make profits based on the price difference calculated between the point where you bought and the price at which you close you trade. Therefore you will make profit based on the price difference - thus the name Contract for Difference - CFD.

One reason why there is an advantage of trading with an online Forex Broker is that you will be trading based on currency prices without necessarily needing to own a Bitcoin wallet. You will just open a trading Account, the same account that is also use to trade traditional currencies such as EURUSD and GBPUSD and you will use this same account to trade Bitcoin using the Currency Symbol BTCUSD.

Once you open a buy position your profit will be calculated based on the difference between the price at which you buy the Bitcoins and the price at which you close your Bitcoin trade.

Therefore, in essence when trading Bitcoin CFD you will be speculating on the price movement of Bitcoin. You do not need to own Bitcoins and therefore you do not need to own a Bitcoin Wallet.

A trader can buy or sell Bitcoins through the online trading platform. Bitcoin can be traded 24 hours 5 days a week.

With this popularity it means Bitcoin as a financial instrument is popular enough to be traded on the online markets as a CFD instrument. Because of the many traders are now trading this cryptocurrency online it means there is always someone willing to buy or sell their Bitcoin contracts at any time of the day when Bitcoin trading market is open.

This liquidity has also led to formation of trends in the price movement of Bitcoin. These trends mean that Bitcoin can be analyzed using technical analysis & online traders can determine which direction the market price of Bitcoin is likely to move in.

Bitcoin now is popular enough to be traded as a CFD financial instrument in the online market and this has led to many online currency brokers to provide Bitcoin as one of the financial instrument that online traders can trade through the broker's online trading platform.

The main online brokers offering Bitcoin as a financial instrument that can be traded are - Forex brokers.

Forex brokers have been providing currency trading services to traders because the currency exchange market is the largest financial market and the most liquid. This is why currency prices move in trends because of this liquidity. The currency traders who trade Forex use technical analysis to analyze the direction of these trends and then place trades on the currency market so as to make profits from this price movements.

Now that Bitcoin has gained a lot of popularity, Bitcoin prices now also form trends that can be traded and analyzed. This liquidity in Bitcoin has led to the formation of these price trends. The liquidity of Bitcoin also means that there are enough traders willing to buy or sell at any time when the Bitcoin market is open.

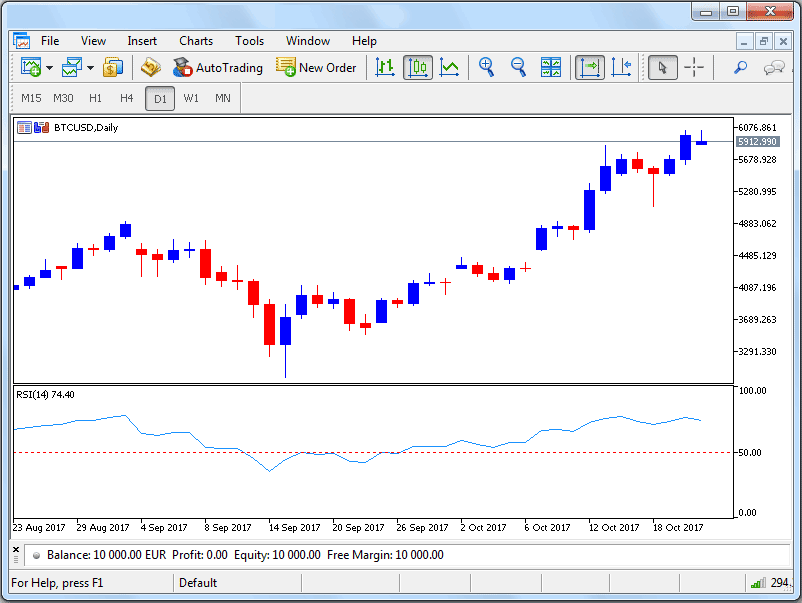

The chart below shows the price chart of Bitcoin. Traders will trade Bitcoin using this price chart.

Bitcoin Price Chart

About Bitcoin Charts

From the chart above a trader can quickly determine the direction of the Bitcoin price from the price movements.

The first part prices are moving upward in an upward trend, they then begin to move downwards in a downward market trend and then finally the prices move upwards in an upward market trend.

As a beginner trader wanting to trade Bitcoin you will have to learn how to analyze these market movements.

For example on our chart above we use the moving average crossover trading system which is a combination of two moving averages and these two moving averages are used to show the direction of the market trend.

If both moving averages are moving upwards then the direction of the Bitcoin price is in an upward trend. In an upward trend a trader will buy Bitcoin and make profit as the prices of Bitcoin continue moving upwards.

The moving averages will also show when the trend is changing direction. When the two moving averages stop moving upwards and crossover each other this will show that the upward trend has reversed or the upward momentum is slowing down and traders should close all their open buy trades.

After the moving average crossed over each other the two averages then changed their direction and started moving downwards. In a downward trend a trader will close his open Bitcoin trades and make profit as long as Bitcoin prices continue to move downwards.

In the above example there is also the RSI indicator. This btcusd indicator has a center line marked 50, when this indicator is above the 50 mark - prices are bullish, when RSI is above 50 mark it means prices are generally closing higher than where they open meaning the price movement is bullish. When RSI goes below 50 mark it shows prices are closing lower than where they open meaning the prices are bearish.

Technical Analysis of BTCUSD Trading

When it comes to Bitcoin trading - traders will use technical analysis & technical indicators like the ones shown above to determine the direction of the market prices. After determining the direction of the market prices a trader will then open bitcoin trades in direction of the trend.

If the trend is upwards then a trader will open buy trades and if the market trend is downward a trader will open sell trades.

Buying is known as Going Long and selling is known as Going Short.

Bitcoin traders can make profit when the market is trending upwards or downwards. When the market is trending upwards a trader will buy Bitcoins " this is known as going long. When the market is going downwards a trader will sell Bitcoins " this is known as going short.

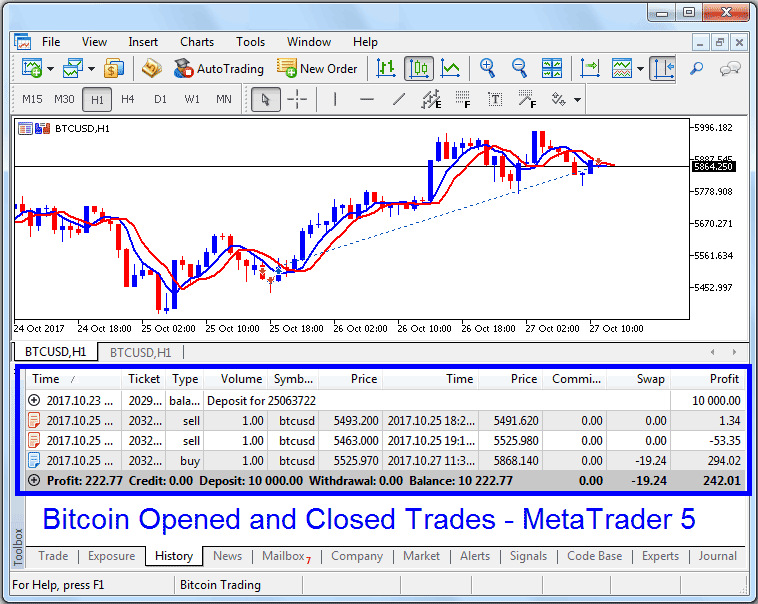

Trading Bitcoin Contracts

In the online market Bitcoin is traded as contracts, no physical Bitcoin is exchanged. When it comes to contracts " one Bitcoin contract is equivalent to 1 unit of Bitcoin.

To trade Bitcoin CFD online a trader does not need to own a bitcoin wallet, a trader will be trading bitcoin CFD - Contract for Difference. The profits and losses from the bitcoin trades will be calculated from the difference between the opening price & the closing price of a trade.

When it comes to Bitcoin CFD a trader wanting to buy Bitcoins will buy a contract and this contract will represent 1 bitcoin. A trader who wants to sell Bitcoins will sell a contract and this contract will represent one bitcoin.

If the unit used to measure Bitcoin is 1 Bitcoin, then one contract of Bitcoin that is traded in the online exchange market represents 1 unit of Bitcoin.

If the price of 1 Bitcoin is $5,684 as shown above then one contract of bitcoin will represent $5,684 dollars. As a trader if you have $5,684 dollars you can trade one bitcoin CFD contract - However, with leverage 5:1 provided for by online Forex brokers who now provide BTCUSD financial instrument for trading - a trader only requires to have one fifth of this bitcoin contract amount - if bitcoin price is $5,684, then a trader only needs $1,136.80 in their account to trade 1 Bitcoin contract.

A trader will get leverage of 5 times the amount in their account, therefore to trade 1 bitcoin contract of $5,684 a trader only requires to have $1,136.80 in their account - the rest of the amount they will borrow from their online Forex and Cryptocurrency broker and use this borrowed amount to trade bitcoins.

Bitcoin Leverage

Bitcoin CFD or BTCUSD brokers provide leverage for trading bitcoins with. Therefore, a trader does not require to deposit all the amount to trade 1 bitcoin. The leverage provided by brokers is 5:1, this means that traders will only be required to deposit one fifth of the amount of one Bitcoin contract and they will then borrow the rest of the amount from their bitcoin broker.

For example, if a trader deposits $10,000 in their Bitcoin account - the trader can then borrow up to 5 times this amount and use this amount to trader with. The leverage is 5:1 - meaning with $10,000 a trader can borrow up to 5 times to trade with - $10,000 multiplied 5 times is $50,000.

Therefore, a trader with a deposit of $10,000 - the trader can control an amount 5 times their deposit - this amount will be equal to $50,000 and this means that a trader can trade up to 8 bitcoins ($5,684x8=$45,472). 8 Bitcoins equal to 8 Lots of Bitcoins.

This is one advantage of trading Bitcoins with an online Forex and Bitcoin broker as opposed to trading Bitcoins using a bitcoin wallet. With an online bitcoin broker a trader will only need to open an online trading account with their broker, deposit money in this account and use this account to trade Bitcoin contracts online.

BTCUSD Prices

In the chart above the price of Bitcoin is represented on the chart. The price of Bitcoin will also have three decimal points and this is the format used to quote the price of Bitcoin.

BTCUSD Charts

The historical prices of Bitcoin will be used to draw a Bitcoin price chart. This price chart is then used by traders to determine which direction the Bitcoin market trend is likely to continue moving in. Traders will analyze the chart price movement using technical analysis & technical indicators.

The Bitcoin chart is the main tool used to trade Bitcoins online.