Characteristics of the 3 Major Trading Market Sessions: Asia, Europe & US Market Sessions

Asian Market Session

During the Asian session only 8 % of total daily transactions go through Tokyo desks. This is the least active of the three major trading sessions in the international financial markets. Most of thethis 8 % only involves Japanese yen based currency pairs with little trade transactions happening for other instruments such as Bitcoin or US Dollar and other international currencies. This is the reason why it is not suitable for one to trade Bitcoin cryptocurrency during this period. Not trading this period will save you a lot of time & money.

European Market Session

The London/European market session takes the majority share of the total financial markets transactions, 34% of all financial market transactions are carried out during this European session. London time-zone is also well placed in terms of business hours for both eastern & western economies, this is when there are trading session over-laps and this results in a high number of trading transactions during the this period. This time is most liquid and most volatile trading session for all the forex pairs as well as Bitcoin cryptocurrency.

The Europe time-zone also includes the euro zone member countries. The Euro zone has 17 members and major banks of these countries are open and there is a lot of liquidity as many financial transactions are being executed at this time.

US Session

The US market session takes up 20% of all financial market transactions. The most active time for trading is approximately from 8 am to 12 pm GMT when both London and New York dealing desks are open for trade transactions. This is the time when there is the highest volatility as it is also the time when the majority of the major USA economic data announcements are announced.

European and US Market Sessions Overlap

Although the online financial markets are open 24 hours a day during the week, there are time periods which have a greater volume of trading transactions, thereby increasing the opportunities for traders to make a profit.

For day traders trading Bitcoin bitcoin trading online the most productive hours are the London and the US market session overlaps and this is the peak for financial transactions - when these two trading sessions over-lap when there is a large volume of trading transactions and the market is most active.

During this overlap a significant amount of fundamental economic news reports are released generating a lot of volatility and the BTCUSD prices are very liquid and move very fast and there is plenty of opportunities to trade BTCUSD, this overlap offers the best opportunity for those Bitcoin traders wanting to maximize profit.

The best hours for trading BTCUSD, are during this market overlap because the Bitcoin prices really move & the moves are decisive & offer the best opportunity to make profits.

This is also why Asian traders, like the Japanese traders will wait until afternoon to start executing their trading orders; this is the period that will coincide with the Europe and US sessions.

Asian investors will not open trades during the Asian time, therefore as an investor from anywhere else in the globe it is also best to stay away at this market time, after all even the hedge funds and other pro investors from Asia will avoid trading during this time and will wait until in the afternoon to trade - when it is much easier because of the liquidity available during the US and UK session overlaps.

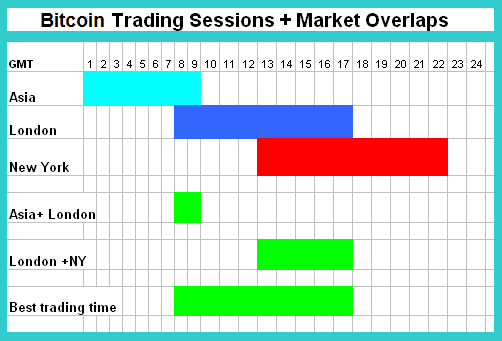

Therefore to come up with the best trading hours based on these three trading sessions is depicted below:

Market Session Hours and Trading Sessions Over-laps - Best Bitcoin Trading Times

The chart above displays the time table of when each market session starts and when it ends. The chart also displays when there are session overlaps and also displays the best trading hours to trade Bitcoin and other financial instruments based on these financial market overlaps.

Summary:

Determine Your Bitcoin Trading Schedule

The type of Bitcoin trader that you are determines your trade schedule. If you do not have a lot of time then a longer term Bitcoin trading strategy would suit you best. If on the other hand you have a lot of time then you may decide to set a day trading schedule where you open trade transactions during the most active market trading hours. The above chart displays the best GMT times to be trading in the market - from around 800 GMT and 1800 GMT.

Determine Your Chart Timeframe

To set up a Bitcoin trading schedule you need to determine your chart time frame that you will be trading with. Try using different chart time frames until you find the most suitable chart time frame to use in accordance with your trading schedule.

Test Your Strategy

Test your Bitcoin trading strategy on a practice practice trading account for a period of time. Keep track of every trade transaction & monitor the progress of your trading style. Try to analyze what times are the most profitable for your Bitcoin trading strategy.

Your trading strategy should be specified on the Bitcoin trading plan that you will be using when trading Bitcoins online.

To learn more about how to specify your Bitcoin trading strategy in your trading plan, study the lesson about writing a Bitcoin trading plan. This tutorial will show you an example of a format that you can use to specify your Bitcoin trading schedule.