Multiple Time Frame Analysis

Multiple time frames analysis equals using 2 chart timeframes to trade cryptocurrency trading - a shorter one used for trading & a longer one to check Bitcoin trend.

Since it's always good to follow the trend, in Multiple Time Frame Analysis, longer timeframe gives us the direction of the long term trend.

If the long term market direction supports the direction of the smaller chart timeframe then probability of being profitable is greatly increased. This is because even if you make a mistake the long term bitcoin trend will eventually save you. Also if you trade with the direction of the market, then mostly you will be on winning side, this is what this analysis is all about.

Remember there's a popular saying by many Bitcoin and stock market investors that says: "The bitcoin trend is your friend' - never go against the btcusd trading market.

There are four different types of Bitcoin traders - all these use different charts to trade as explained below.

Examples of how each type of BTCUSD trader uses multiple Bitcoin BTCUSD Trading timeframes analysis strategy:

Scalpers

This group holds on to their trades for only a few minutes. Scalper never holds on to a trade for more than ten minutes. With the objective of making a small amount of pips as profit, 5 - 20 pips.

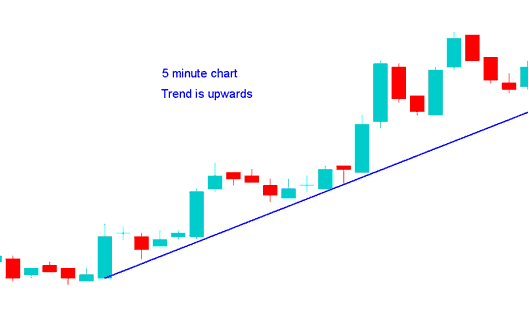

A Scalper using 1 min chart wants to go long, checks 5 min trading chart, that look like the one below, since 5 min illustrate bitcoin trend is moving up, then decides from this analysis it's okay to buy.

Day Traders

This group holds on to their trades for a few hours but not more than a day. With the aim of making quite a number of pips: 30 - 100 pips.

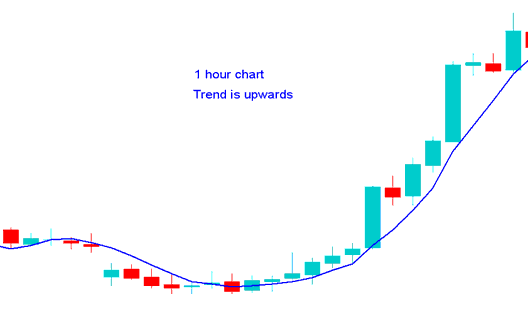

Day trader trading 15 min chart wants to go long, checks 1 Hour chart, that look like the one below, since 1 hour displays market bitcoin trend is moving up, then decides from this analysis it's okay to buy

Swing Traders

This group holds on to their trades for a few days to a week. With the aim of making a large number of pips: 100 - 400 pips.

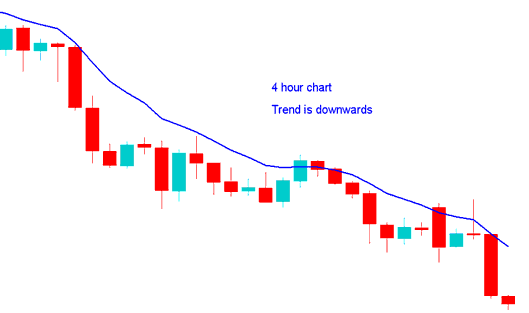

Swing trader using the 1 Hour trading chart wants to go short, checks the 4 Hour chart, that look like the cryptocurrency trading example illustrated below, since 4 hour displays the bitcoin trend is moving down, then decides from this analysis it's okay to sell.

Position traders

These are the investors that hold on to their trades for weeks or months. With the aim of making a large number of pips: 300 - 1000 pips.

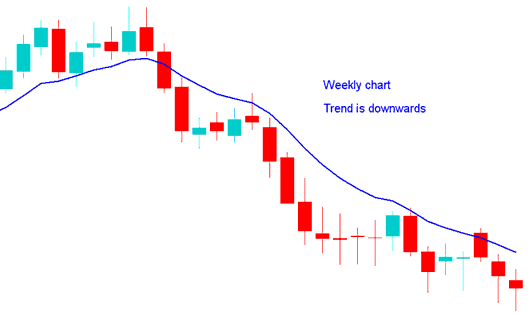

Position trader using the daily trading chart wants to go short, checks weekly chart, weekly looks like the one below, since weekly displays the bitcoin trend is moving down, then decides from this analysis it's okay to sell.

How to Define A Bitcoin Trading Trend

Using a bitcoin trading system has Three indicators - MA Crossover System, RSI & MACD & uses simple guidelines to define the trend. The rules are:

Up-wards trend

Both MAs Moving Up

RSI above 50

MACD Above Center Line

Down-ward BTCUSD Trading Trend

Both MAs Moving Down

RSI below 50

MACD Below Centerline

For More explanation about this system read: How to Generate Bitcoin Trade Signals with a Bitcoin Trading System.