How Can Spinning Tops Candle-sticks and Doji Patterns on Cryptocurrency Charts Be Traded?

Spinning Tops Candle Pattern Setups

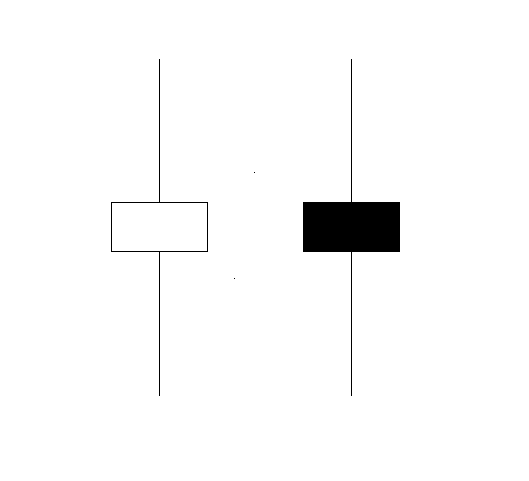

Spinning tops candlesticks pattern setup have a small body with long upper and lower shadows. These spinning tops are referred to by this name of spinning tops because they are similar to spinning tops on a matchstick.

The upper & lower shadows of the spinning tops are longer than the body. The example illustrated below shows the spinning tops pattern. You can look for the pattern on your MetaTrader 4 BTCUSD Crypto Currency Platform charts. The example illustrated below shows a screen-shot to help traders when it comes to learning and understanding these formations.

How to read candlestick charts - Spinning Tops

Colour of spinning tops candle is not very important, this formation show the indecision between the buyers and sellers in the btcusd trading market. When these btcusd patterns appear at the top of a bitcoin trend or at the bottom of bitcoin trend it might signal that the bitcoin trend is coming to an end & it may soon reverse and start going the other direction. However, it's best to wait for confirmation signals that the direction of a bitcoin trend has reversed before trading the signal from this chart formation.

Candle Reversal Patterns Formations on Charts

At the top of an up-wards bitcoin trend a black/red spinning tops shows that a reversal is more likely than when color of the candlestick is white/blue.

At the bottom of a Cryptocurrency downward bitcoin trend a white/blue spinning top shows that a reversal is more likely than when the color is black/red.

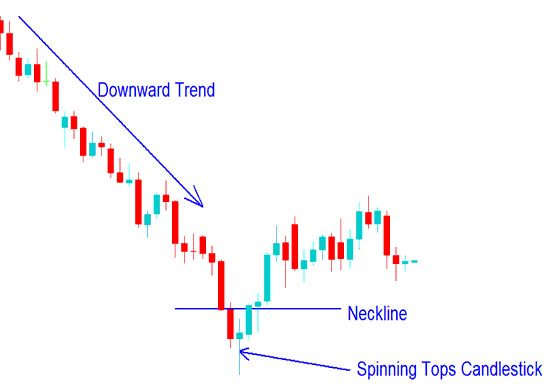

This reversal cryptocurrency signal is confirmed when the next candlestick pattern that forms after the spinning tops closes below the neckline for a downward bitcoin trend reversal cryptocurrency signal confirmation, and closes above the neckline for a reversal cryptocurrency signal in a downwards trend.

The neck line is:

- For an Upwards Bitcoin Trend - The open of the previous candlestick that was drawn just before the spinning top.

- For a Downward Bitcoin Trend - The open of the previous candle that was drawn just before the spinning top

Shown Below is an example of this Japanese charting techniques where this pattern has formed & how to trade it. On the trading chart below when the bitcoin price moved above the neckline the reversal cryptocurrency signal given by the spinning top candlestick was confirmed and this was a good point to exit the short sell bitcoin trade.

Spinning Top Pattern on a Chart

The colour of spinning top formed is blue therefore meaning that a reversal was more likely as opposed to if the color had been red.

Doji Candles Pattern

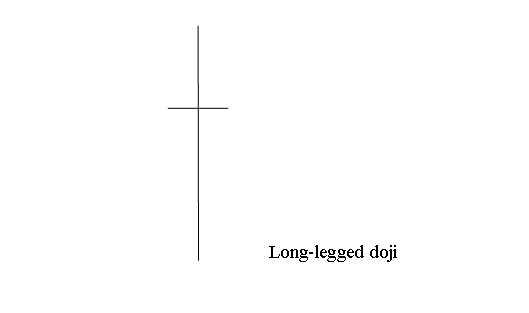

This is a pattern with same opening & closing bitcoin price. There are various types of doji candle-stick setups that form on charts.

The following example show various patterns of the doji candle:

Long legged doji candle has long upper and lower shadows with opening and closing bitcoin price at the middle. When Long-legged doji appears on a Bitcoin chart it demonstrates indecision between the cryptocurrency traders, buyer & the sellers.

Shown Below is an example screenshot image of the Long Legged

- Doji cryptocurrency chart pattern

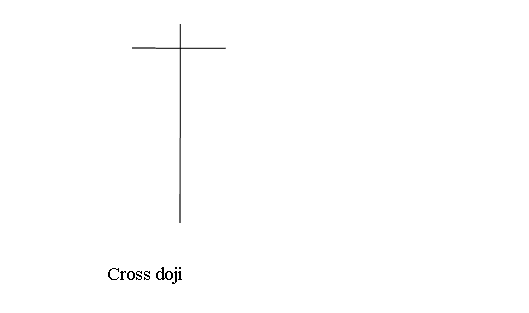

Cross Doji BTCUSD Candlestick

Cross doji has a long lower shadow & a short upper shadow and the open & close of the day is the same.

This bitcoin pattern appears at market turning points and warns of a possible bitcoin trend reversal in the Bitcoin. Below is as example of this chart formation

- Cross Doji Pattern

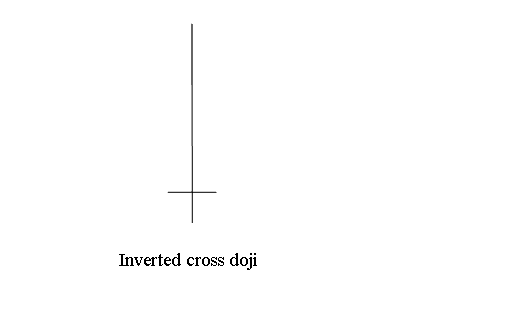

Inverted Cross Doji Bitcoin Candlestick Pattern

Inverted cross doji candles have a long upper shadow & a short lower shadow & the open & close is the same.

This reversal bitcoin pattern appears at market turning points and warns of a possible bitcoin trend reversal in the Bitcoin. Below is an example

- Inverted Cross doji

Analysis in BTCUSD Trading - All doji candle-sticks pattern setup show indecision in the btcusd trading market this is because at the top of bulls were in total control, at the bottom the sellers were in control but none of them could gain control and at the close of the btcusd trading market the bitcoin price closed unchanged at the same bitcoin price as the opening bitcoin price. This doji shows that the overall bitcoin price movement for that particular day was 0 pips or just a min range of 1 3 pips. Reading these charts patterns require very small pip movement between the opening bitcoin price & closing bitcoin price.