Stochastic Bitcoin Indicator Overbought & Oversold Levels

Stochastic oscillator cryptocurrency indicator is used to look for overbought/oversold cryptocurrency signals. Overbought levels are above 80% level & oversold levels are below 20% level.

The key is to not only look at Stochastic oscillator cryptocurrency indicator when the %K or %D lines touch or cross overbought/oversold, but also when they cross over & back through these levels.

Just as with other bitcoin trading momentum indicators such as RSI cryptocurrency indicator the Stochastic oscillator cryptocurrency indicator can stay inside the overbought and oversold levels for some time. When this bitcoin trading stochastic oscillator indicator stays within these levels for a long time it indicates strong upward bitcoin trend (overbought) or strong downward bitcoin trend (oversold).

When the stochastic lines cross back below or above these overbought and oversold levels it's usually a good indication of an upcoming bitcoin trend reversal.

A trader can look for further bitcoin signals to make the oversold or overbought levels more reliable if:

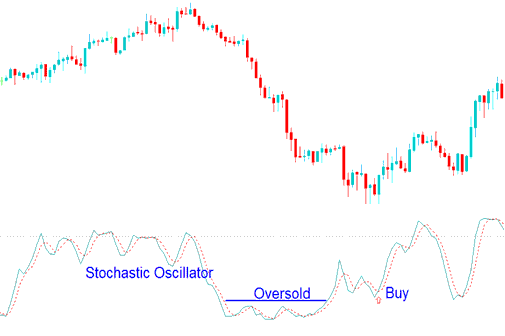

Buy Bitcoin Signal Using Stochastic Oscillator Oversold Levels

- Before Buying, the %K & %D lines turn upward from below 5%.

- A reading that is floating near 5% means that bitcoin trading bears are in control and there is selling of bitcoin crypto. A trader should wait for the Stochastic Oscillator to move back above 5% as a sign that the selling pressure is easing.

The Buy cryptocurrency signal is confirmed when the stochastic oscillator cryptocurrency indicator moves above oversold, then after a while returns to oversold but this time moves up immediately without staying at the overbought.

Buy Crypto Signal Using Stochastic Oscillator Oversold Levels

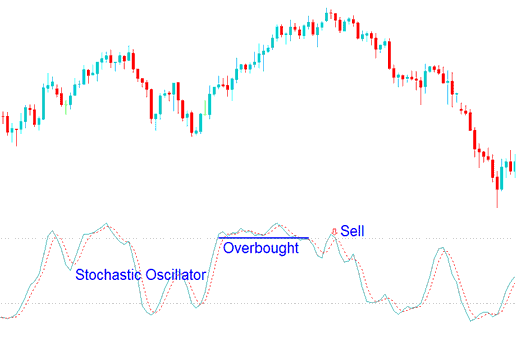

Sell Bitcoin Signal Using Stochastic Oscillator Overbought Levels

- Before Selling, the %K & %D lines turn down from above 95%.

- A reading that is floating above 95% means that bitcoin trading bulls are in control and there is buying of bitcoin crypto. A trader should wait for the Stochastic to move below 95% as a sign that the buying pressure is easing.

- The sell cryptocurrency signal is confirmed when the stochastic moves below overbought, then after a while returns to overbought but this times moves down immediately without staying at the overbought.

Sell Crypto Signal Using Stochastic Oscillator Overbought Levels

Looking at different crypto chart time frames when using oversold and overbought levels can also help to determine the correct entry strategy when opening a bitcoin trade.

The main theory is to trade with the btcusd trading market trend. Always double check the bitcoin trading signals with the longer term stochastic oscillator indicators to confirm bitcoin trading signals on the shorter crypto chart time frame periods.