Bitcoin Indicators for Setting Stop losses in Bitcoin Trading

Some cryptocurrency indicators are used for setting stop losses taking away the need for cryptocurrency traders to perform complex calculations on where to place these stop loss bitcoin orders.

A bitcoin trading systems trader can also set a stop loss bitcoin order according to these cryptocurrency indicators. Some crypto indicators use mathematical equations to calculate where the order stop loss cryptocurrency order should be set so as to provide an optimal exit. These cryptocurrency indicators can be used as the basis for setting stop loss cryptocurrency orders. These crypto indicators follow bitcoin price action of a bitcoin trading instrument closely and define the boundaries which the bitcoin prices should move along in. When the bitcoin price moves outside these boundaries it is therefore best to close the open cryptocurrency trades because bitcoin price stops moving in that particular direction.

Some of the Technical cryptocurrency indicators that can be used to set stop loss crypto orders are:

Automatic Stop Loss BTCUSD Order & TP Bitcoin Order Technical Indicator

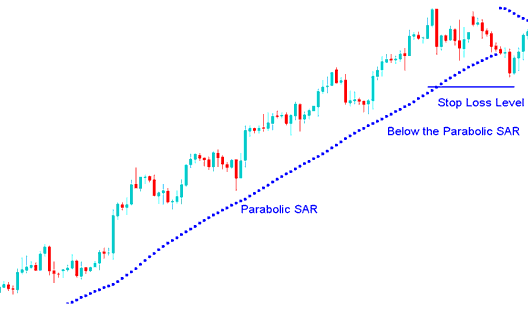

Parabolic SAR is like an Automatic Stop Loss Bitcoin Order & TP Bitcoin Order Indicator used to set a trailing bitcoin price stop loss

The Parabolic SAR provides excellent exit points.

In an upwards bitcoin trend, you should close long trades when the bitcoin price falls below the Parabolic SAR indicator

In a downwards bitcoin trend, you should close short trades when the bitcoin price rises above the Parabolic SAR.

If you are long then the bitcoin price is above the parabolic SAR, the SAR will move up every day, regardless of the direction in which the bitcoin price is moving. Amount the Parabolic SAR indicator moves up depends on the amount that bitcoin prices moves.

Parabolic SAR - Cryptocurrency Indicator - Automatic Stop Loss Bitcoin Order & TP Bitcoin Order Technical Indicator

Picture of parabolic SAR & how it is used

Crypto Indicator for Setting Stop Loss Bitcoin Orders

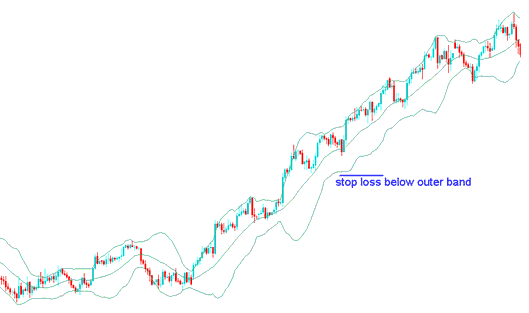

Bollinger bands indicator use standard deviations as a measure of volatility. Since standard deviations indicator is a measure of volatility, the Bollinger bands are self-adjusting meaning they widen during periods of higher volatility and contract during periods of lower volatility.

Bollinger Bands cryptocurrency indicator consist of 3 bands designed to encompass the majority of a crypto trading instruments bitcoin price action. The middle band is a basis for the intermediate term bitcoin trend, mostly it's a 20 day period simple moving average, which also serves as the base for calculating the upper band & lower band. The upper band's and the lower band's distance from the middle-band is determined by the price volatility.

Since these Bollinger bands are used to encompass the btcusd trading price action, bands can be used to set stop loss orders outside the areas of the bands.

Bollinger Band Setting Stop Loss Bitcoin Order Level - Bollinger Bands Bitcoin Technical indicator

Automatic Stop Loss Bitcoin Order & TP BTCUSD Order Technical Indicator

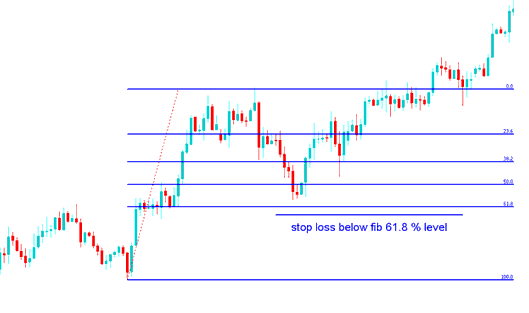

Fib retracement levels provide areas of support & resistance, these can then be used to set stop loss levels.

Fibo Retracement level 61.8 % is the most commonly used level for setting stop losses. A stop loss bitcoin order should be set just below 61.8 % fib retracement level

The 61.8 % Fib retracement level indicator is used to set these orders since its rarely hit.

Fibonacci Indicator Stop Loss Crypto Order Setting at 61.8% Retracement Level

Fibonacci retracement level 61.8% - Fibonacci Crypto Indicator

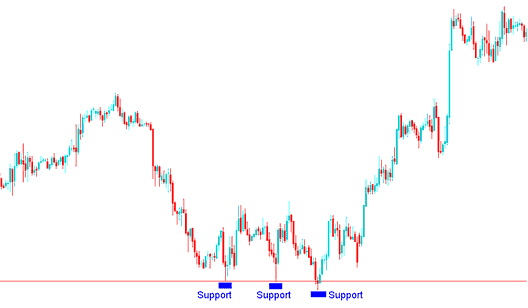

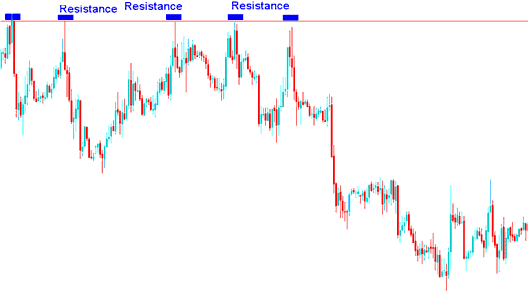

Support & Resistance Levels Lines

Support and resistance levels can be used to set stop loss levels where the stop loss cryptocurrency orders are set just above or below the support or resistance.

- Buy Bitcoin Trade - Stop Loss Bitcoin Order set few pips below the support

Buy BTCUSD Trade - Stop Loss Bitcoin Order set a few pips below the support

- Sell Bitcoin Trade - Stop Loss Bitcoin Order set a few pips above the resistance

Sell BTCUSD Trade - Stop Loss Bitcoin Order set few pips above the resistance