What is Bitcoin Price Action in Bitcoin Trading?

Bitcoin Trading bitcoin price action is the analysis of bitcoin price movements that are drawn on bitcoin charts.

Bitcoin Trading bitcoin price action analysis uses line studies or bitcoin price action patterns to try and determine the bitcoin trend of the bitcoin price chart.

Bitcoin Trading bitcoin price action signals can also be combined with bitcoin systems that can be used to determine what direction of trading to take.

Pin Bar Bitcoin Price Action Trading Strategy

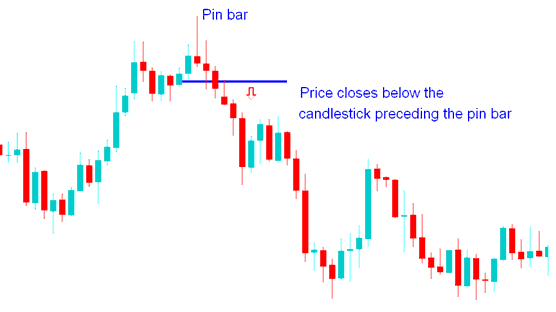

A pin bar is a bitcoin trend reversal cryptocurrency signal on a bitcoin price chart which shows an obvious change in btcusd market sentiment during that period.

This pin bar bitcoin price action set up has a long tail with the closing bitcoin price near the open. The pin bar pattern looks like a pin thus the name Pin Bar - forms after an extended trend move up or down.

This bitcoin trend reversal is confirmed after market closes below the candle that precedes this bitcoin price action pattern. Below the reversal setup is confirmed after the btcusd trading market bitcoin prices closes below the blue candle that preceded this pin-bar candle.

BTCUSD Price Action 1 2 3 Method in Bitcoin Trading

Bitcoin Price action trading strategy is use of only bitcoin price charts to trade Bitcoin, without the use of technical chart technical indicators. When trading with this technique, candle crypto charts are used. This strategy uses lines and pre-determined patterns such as the 1-2-3 pattern that either develops as one bitcoin price action pattern or series of bitcoin price action setups.

Traders use this bitcoin price action bitcoin strategy because this analysis is very objective and allows the one to analyze the bitcoin price market moves based on what they see on the crypto charts and market movement analysis alone.

This strategy is used by many traders: even those who use technical indicators also integrate some form of bitcoin price action in their strategy.

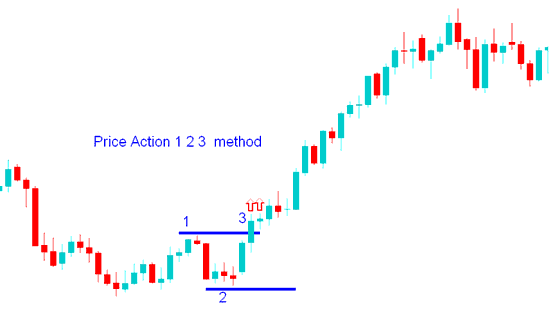

BTCUSD Price Action 1-2-3 Break out Strategy

This bitcoin price action strategy uses three chart points to determine the break out direction of bitcoin crypto. The 1-2-3 method uses a peak and a trough, these points forms point 1 and point 2, if market moves above the peak the trade signal is long, if it moves below the trough the trade signal is to short. The break out of point 1 or point 2 forms the third point.

Bitcoin Price Action 1-2-3 Break out Bitcoin Strategy Example

Combining Bitcoin Price Action Trading Strategy with other Indicators

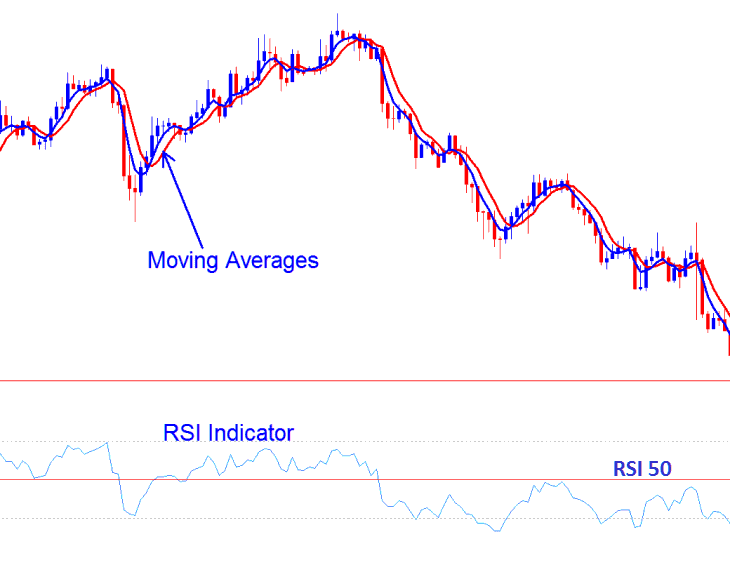

Good bitcoin indicators to combine bitcoin price action trading patterns with are:

- RSI

- Moving Average Technical Indicator

Traders should use these two bitcoin indicators to confirm if the direction of the bitcoin price action breakout is in line with the bitcoin trend direction shown by these two cryptocurrency chart indicators. If the direction is also the same as the direction of these crypto indicators then cryptocurrency traders can open a trade in direction of the crypto signal. If not traders should not open a trade as there is more likely a chance that this cryptocurrency signal may be a bitcoin trading whipsaw.

Just like any other chart indicator in Bitcoin Trading, bitcoin price action trading strategy also has whipsaws and there is a requirement to use this strategy as a combination with other cryptocurrency trading signals as opposed to just using this bitcoin price action trading strategy alone.

Combining Crypto Price Action Trading Strategy other Technical Indicators - RSI & Moving Averages Bitcoin Price Action Trading Strategy