Stochastic Momentum Index Bitcoin Analysis & Stochastic Momentum Index Trading Signals

Developed by William Blau.

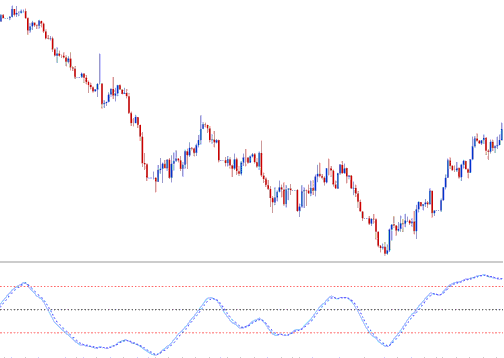

Stochastic Momentum Index, SMI indicator is an adaptation of the classic Stochastic Oscillator indicator which smoothes out the stochastic oscillations.

Construction of Stochastic Momentum Index Technical Indicator

This btcusd indicator is calculated by comparing the bitcoin price relative to the average of an n number of periods.

Then instead of plotting these values directly, smoothing using an Exponential Moving Average is applied & then the values drawn to form the SMI.

When the closing bitcoin price is greater than the average of the range, the SMI will move up.

When the closing bitcoin price is less than the average of the range, the SMI will move down.

This oscillator ranges between the values of +100 & -100, this indicator is also less prone to whipsaws compared to the stochastic oscillator.

Bitcoin Analysis & Generating Trading Signals

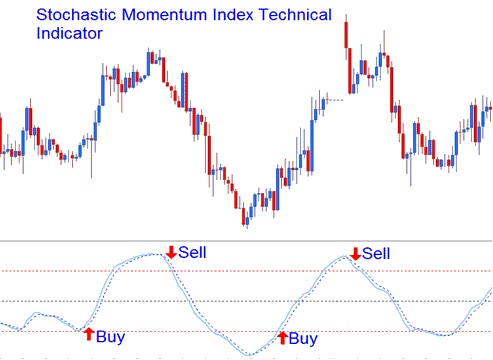

Buy & Sell Bitcoin Signals/ Crossover Signals

The Stochastic Momentum Index can be used to generate buy & sell cryptocurrency signals using the method shown below, Buy when the SMI is heading upwards and sell when its heading downwards.

Buy and Sell Bitcoin Signals/ Crossover Signals

Overbought/Oversold Level Bitcoin Trading Crossovers

- Overbought levels above +40

- Oversold levels below -40

Buy signal is generated when this oscillator falls below oversold level & then rises above this level & starts to move upwards.

Sell Bitcoin Signal is generated when this oscillator rises above overbought level & then falls below this level & starts to move downward.

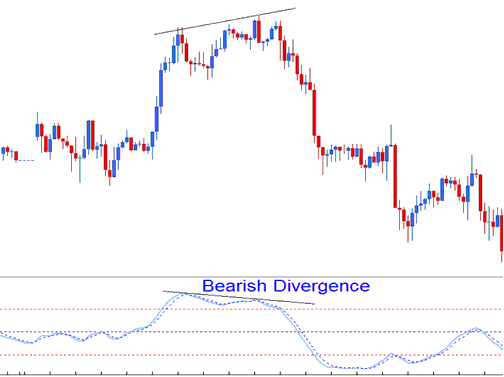

Divergence BTCUSD Trading

The example illustrated below shows a bearish classic divergence between the bitcoin price & the SMI. When the Stochastic Momentum Index showed this divergence the bitcoin price bitcoin trend reversed and started to move in a downward direction.

Bearish Bitcoin Trading Divergence